Post-covid stabilization and hyper expansion

Description

Logic Instrument began its operations in 1987 with a core focus on mobile solutions for challenging and extreme environments. Specifically, the company designs and provides rugged computers, servers, phones, and tablets for the industrial sector, defense, and other enterprises. It has a broad and diversified customer base, including globally recognized names. The stock is trading at an FY EV/EBITDA of 3.4, an EV/EBIT of 4.3, and a P/B ratio of 1.3.

Headquartered in France and listed on the Paris Alternext Stock Exchange, Logic Instrument is trading at a market capitalization of approximately €8 million. The company also has offices in Germany and the UK to leverage professional expertise. Its distribution channels and product resellers cover markets ranging from the EU and the Middle East to Africa. Logic Instrument is a subsidiary of the larger Archos Group, which focuses on consumer electronics. Archos provides external technological and operational support to Logic Instrument at no additional cost.

After a temporary operational downturn between 2019 and 2021 caused by COVID-related issues (such as delayed customer orders), Logic Instrument has returned to both organic and acquisition-driven growth, while also regaining pre-COVID margins. The company is now at an inflection point following the successful integration of its 2023 acquisition without dilution. It has achieved up to €30 million in pro forma revenues for 2024 (€21 million between Q1–Q3) and is projecting €50 million in full-year revenues for 2025, up from €9 million in 2022. A reported year-over-year 9-month growth of 135% highlights management's ability to deliver on its promises. The story that began in 2015 and faltered in recent years is now back on track.

Note: Due to limited proficiency in French, there may be some discrepancies in the allocation of COGS and OPEX. As a result, greater emphasis is placed on operating profitability.

Product snapshot

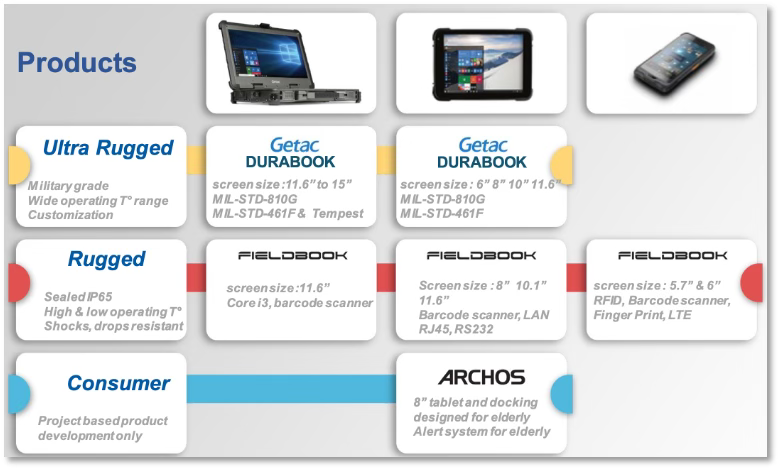

Logic Instrument divides its available products into three distinct categories, each tailored to specific tasks and environments. The categories are:

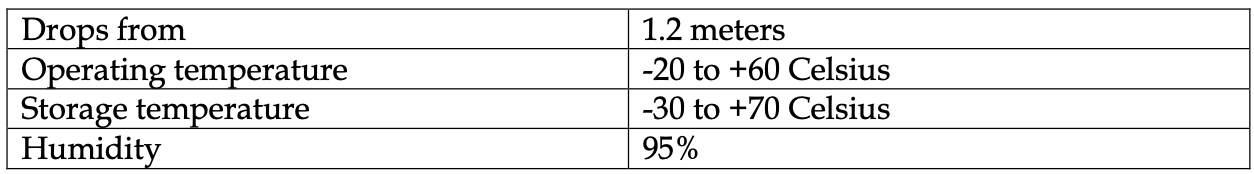

Logic Instrument is recognized by ISO 9001/2015, AQAP 2110/2016, and CAGE standards, and is authorized to provide equipment and products for a variety of purposes within the sector. Most of their products are certified to withstand, for example:

Key to sustainable operational activity

To some extent, you could compare Logic Instrument to an old-school tailor. In situations where you need computing power to withstand unique, challenging environments, you turn to Logic Instrument—you won’t build it yourself. Logic provides customized hardware, firmware, and software for specific working environments upon request. They can modify aspects such as storage, screen size, launchers, applications, branding, connectors, and more. Logic also develops tailored accessories for industrial customers, such as carrying systems, docks, chargers, and keyboards. In the defense sector, Logic is authorized to supply the military industry and customize hardware to meet unique client requirements. Additionally, there are partnerships with independent laboratories to certify this equipment to military standards. The product and service cycle begins with the pre-sales team, supported by research and development, followed by post-sales technical support, and concludes with warranty services that extend up to 5 years from the purchase date (the expected lifetime of the product).

As you have noticed, Logic Instrument is a blend of strategic partnerships aimed at producing high-quality products for specific customer needs. The business model includes its in-house brand, ODM partnerships, base-tech providers such as Getac, the Archos R&D unit and capital lending support, and the broader operating structure. The quality of service has been recognized by industrial companies such as Mercedes, Volkswagen, and Bosch, as well as by military organizations. Sales are roughly split 50/50 between defense and industrial sectors, with most customers placing repeat orders. Although the distribution covers the EMEA region, the majority of sales come from France and Germany.

In its latest report, Logic revealed plans to continue expanding its product portfolio, focusing on computing solutions for the defense and extreme conditions segments, while also broadening its client base by recruiting industry experts. Logic is also actively engaged in discussions with potential targets to explore external growth opportunities in this specific sector.

To gain future perspective, we should examine the past. In October 2023, Logic acquired Elexo, a subsidiary of the Atos Group, for €4.5 million (plus an additional €0.5 million over two years if Logic meets certain targets), financed with debt. Elexo brought new rugged product expertise and architecture for testing, measuring, and security. This acquisition has positioned Logic as a leading sovereign player in the market.

By the end of 2023, Logic achieved €16 million in revenue, a 65% growth, with 28% organic growth included, and operating profit returned to positive at €0.7 million. In H1 2024, Logic reported €14.6 million in revenue, with operating income of €1 million, reflecting a 7% margin (compared to pre-COVID normalized margins around 4%). The company is on track to reach approximately €30 million in revenue for the full year 2024. The pro forma indicates €32 million in revenue, with a 6% margin before interest and tax, highlighting the impact of the acquisition. With minor adjustments to organic growth and a realistic revenue growth forecast for 2024, we expect the EV/EBIT multiple on the acquisition to be around 4.9x, compared to the pro forma of 4.1x (see sheet below).

In November 2024, Logic announced a binding letter of intent to acquire Artic, a company with over 30 years of experience in computing and operational maintenance. This acquisition would bring clients such as Dassault Aviation and Thales. The acquisition is expected to take effect in early January 2025. Through the Artic acquisition, Logic will expand its services in the distribution and integration of industrial boards, legacy system maintenance, and consulting. The acquisition price and expected pro forma inorganic revenue growth or profitability have yet to be disclosed. Based on previous deals, we anticipate the valuation to be in the mid-single-digit range. Management appears motivated to drive the company towards its €50 million revenue target by 2025 through reasonably priced acquisitions. There are also insider incentives at play, as CEO L. Poirier owns approximately 4.8% of the shares, while the "mother company" Archos holds 24.2% of the shares, also under Mr. Poirier's leadership. Therefore, the insider ownership is effectively higher.

Behind the scenes, Archos, the "mother company," essentially struggled and ultimately faltered while competing with companies producing tablets, smartphones, media players, and storage devices. Archos was forced into restructuring, and during its time in the sector, it destroyed significant value. Since 2015, Logic began to grow, evolving into its current form and doing the exact opposite of what its "mother company" had done. According to LinkedIn, Mr. Poirier was promoted from COO to CEO in 2011, the same year Archos revenues began to decline. Was this due to intense competition from Chinese and other international product manufacturers, poor management, or a combination of both? However, after becoming CEO of Logic Instrument in 2017, the "subsidiary" has performed quite well, excluding the COVID period. So, there's a puzzle for you to solve.

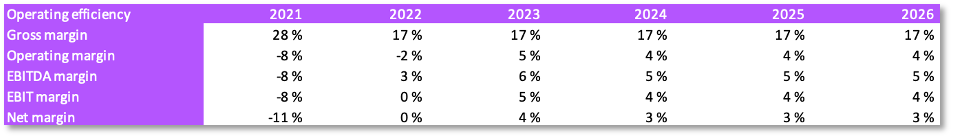

Operations through financials

Between 2015 and 2019, before COVID, Logic grew its revenue at a 9.5% CAGR and was targeting €14 million in 2020 but only reached €9 million due to a halt in customer ordering patterns. After COVID and the pre-acquisitions period, the company began to grow again and is likely to continue expanding with combined organic and inorganic growth rates for several years into the future. Pre- and post-COVID normalized and controlled operating costs also suggest that the operating margin is reasonable at around 4%, so we should exclude the latest reported and expected 6% margin for conservative reasons.

From the latest balance sheet, Logic Instrument has a current ratio of 1.3, a cash ratio of 0.42 (with a cash/financial debt ratio of 1.1), and an equity ratio of 0.37. Improving account management to accelerate receivables turnover while increasing accounts payable for additional cost-free leverage could significantly enhance free cash flow and valuation.

We would classify this business as mediocre. In a normalized environment, it should deliver approximately a 15% return on shareholders’ equity and sustain mid-single- digit bottom-line profitability margins. While the business has demonstrated the ability to achieve operating margins of up to 6-7% during growth periods, we conservatively normalize this figure to 4%.

Valuation

Logic is currently valued at approximately 5x EBITDA and 7x EBIT, assuming the gross margin does not normalize above 4%. At its current state, the business offers some margin of safety. However, if execution aligns with guidance, Logic is projected to trade at around 3x EBITDA and 4x EBIT, alongside a 15% return on equity (assuming a 2% constant revenue growth rate starting in 2025 post-acquisition).

If the company achieves its target as it has so far, and considering the current multiple, Logic could deliver an approximately 70% return at a constant valuation. Even if it falls short, the company still trades at an current EV/EBIT of 6-7. For those inclined to be bullish, there are several drivers (previously mentioned) supporting the 2025 target, though these remain to be fully executed. Post-acquisition, well-managed accounts receivable and inventory stabilization could position Logic at an EV/FCF ratio between 5-10x. However, potential changes in business dynamics following integrations could impact the true free cash flow potential, which is a factor to keep in mind.

We should anticipate some volatility in cash flow due to potential changes in fixed assets from investing activities and the stabilization of inventory or accounts receivable. However, a reasonable range is expected to hover between €0.5 million and €1.5 million against the €8.5 million EV. If management continues to execute external growth initiatives at reasonable valuations to achieve its targets, financing activities should also remain stable, with assets positively aligned against obligations. This is another critical aspect to monitor moving forward.

Market Outlook

Referring to Durabook, the rugged technology segment often involves a degree of uncertainty. However, in 2024, there were increased aerospace and defense spending budgets across Europe. Additionally, there was growth in the oil, gas, and utilities sectors, particularly in field-related services. What remains crucial for Logic is that the demand for customized solutions tailored to industry-specific needs persists and is expected to continue for the foreseeable future. The key driver here is the overarching trend of digitalization spreading across various sectors. Before diving into the competition, here’s a teaser from a similar company operating in the Nordic defense market:

Referring to the snapshot above, we can observe a common theme across Europe that highlights why Logic is focusing on enhancing its capabilities in the defense segment and why the company is well-positioned to achieve revenue growth.

Active peer groups

Globally, there are numerous vendors specializing in rugged technology, with some focused on industrial PCs, others on mobile computers, and others on integrated systems. While a variety of rugged products exist, what sets certain players apart is their ability to establish strategic customer relationships to meet specific needs. For this reason, we selected Mildef Group AB for comparison—a Swedish company specializing in custom-made military-grade IT products and systems.

It’s not entirely possible to make a direct comparison, as Logic Instrument derives only about 50% of its current sales from the defense sector. However, we can make some informed assumptions. Notably, Logic is actively increasing its exposure to the defense market, even as we write. Defense products tend to be price-competitive to some degree, but companies fully dedicated to the defense sector seem to achieve higher gross margins. For Mildef, gross margins have grown from 37% to 50% over six years.

Both companies show some scalability while maintaining a strong focus on operational efficiency. Since the operational shifts that began in 2015, Logic has demonstrated similarities to Mildef, but the defense segment for Mildef appears inherently more efficient. This gives Mildef an edge as a fundamentally strong company. Their normalized operating margins are similar to Logic, but Mildef seems better positioned to extract additional profitability in the future.

While both companies experienced impacts from COVID-19, the effects on Mildef were less pronounced, allowing defense-related growth to continue uninterrupted. This highlights the industrial segment’s greater sensitivity to change from Logic’s perspective. Logic primarily serves central Europe, whereas Mildef’s markets include the Nordics and the US, with 25% of sales in the rest of the EU. This small geographical overlap in central EU might increase competition, maybe.

As seen in the presentation above, Mildef is more specialized in defense products, not just rugged mobile solutions. I also noticed that Mildef has acquired Roda, with the deal expected to close in Q1 2025. Roda's products are currently available for sale and customization in Logic’s portfolio. Should we anticipate future cooperation between Logic and Mildef in central Europe, or is this development bearish for Logic?

Despite differences in segmentation, size, and operational structure, both companies continue to grow for now. Mildef is seeing significant growth in order intake, which Logic doesn’t report, but it is expected to achieve €50 million in revenue, compared to €30 million in 2024. Both companies have similar bottom lines, but Mildef is better managed, more established, operating in a less volatile segment, with stronger investor relations, and is more likely to expand returns through stabilization. Therefore, the higher valuation is justified, but I don’t believe Logic should trade at an FY2024- 2025 EV/EBITDA of 3-4, including the questions we've raised.

Conclusion with risks to bear in mind

The stock is listed in France, but international investor relations are lacking. With a market cap of only €8 million, it often goes unnoticed. The French stock market is also currently out of favor due to political developments. The rugged tech market is less well-known compared to other tech sectors. Referring to Durabook, the rugged product market is harder to predict and estimate. There seems to be a strong uptick in demand, especially from the defense sector, but the size and duration of the cycle remain uncertain. If the segment begins to slow down, there is a risk to profitability due to the thin operating margins and ongoing growth investments. So far, however, Logic has been successful in capturing demand and improving profitability back to, and beyond, pre-Covid levels.

Another aspect to watch is the management's execution and adaptation to changing environments, as the CEO's track record at Archos has been less than stellar, so caution is advised. The impact of Mildef's acquisition of Roda is also something to monitor, particularly regarding how it affects Logic’s product portfolio. Without its industrial segment, Logic could become a potential buyout target for larger players like Mildef.

It seems like the market priced in some of the FY2024-2025 expectations earlier this year, but the stock has since pulled back. I suppose the key here is to monitor the progress while holding onto this company. Post acquisition floor seems to be in after falling below current EV/EBITDA of 5. So far, so good. Thanks for reading.