Description

Alico Inc used to be a Florida-based agriculture business focused on in-house citrus production just a moment ago, and now it decided to become a diversified land developer and operator. Basically, beginning from January 2025, you can ignore the history of the company and focus on the dollar extraction from the properties and counties it owns. This transformation allowed me to throw my past analysis into the trashcan. It’s selling for EV of around 325 million dollars against approx. 700 million dollars of actual land value not even presented in actual dollars, but rather in discounted, present value dollars. We are also excluding the possible incoming hurricane relief funds and other stuff not meaningful anymore.

For the first time in my investing journey, I can see the floor price clearly Infront of me without the need to consider external factors affecting future business value. In simple words, Alico basically turned into undervalued zero-coupon bond. There is no need to invest into working capital of the citrus operation, to maintain the operation related workforce or to bear the hurricane wipeout risk. They even began to sell equipment and vehicles related to citrus operations.

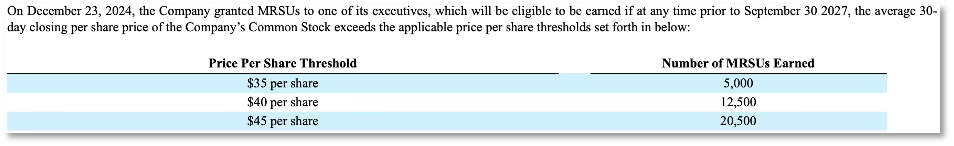

Even the stock-based compensation plan remained after the announcements with thresholds between 35 to 45 dollars per share against 29 dollars today. With a little patience I believe the CEO makes the easiest extra dollars without any meaningful operational risk. We are almost back at the grant date stock price levels of 26 dollars. You don’t have to worry about insider incentives and on top of that they have been shareholder friendly also at the times of citrus business with buybacks and dividends. Management has been down to earth with good balancing between disastrous hurricanes and profitable years. Let’s get into the numbers and properties.

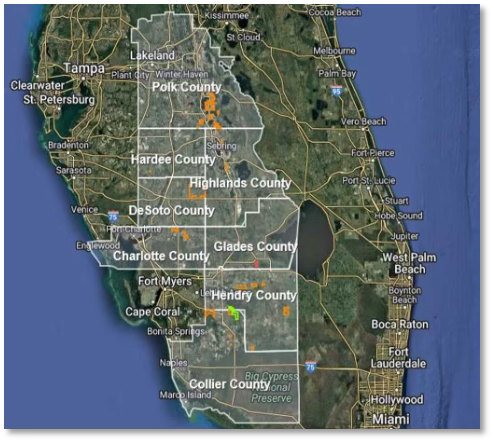

Florida in a snapshot

Florida is one of the fastest growing states in the America with its warm climate and beautiful beaches. The estimates are saying that over 300 thousand new residents move in annually including retirees and remote workers etc. This dynamic is driving housing demand and push home values upward. Based On Gold Coast Shools report from 2024 the number of new listings decreased by 10% and the housing inventory continues to be a critical factor. Single and multifamily home production has been below the demand especially in South Florida where most of Alico’s properties are located.

Alico owns over 53 thousand acres of land in 8 counties and since 2017 has already sold over 40 thousand acres of land in Florida. Only 20 million is expected to be sold FY 2025 due to the property development-required timeline against estimated land value of approx. over 700 million, so a little patience is needed, but the dollars are left on the table for investors to pick up. This near-medium-term development structure is what makes this company comparable to zero-coupon bond.

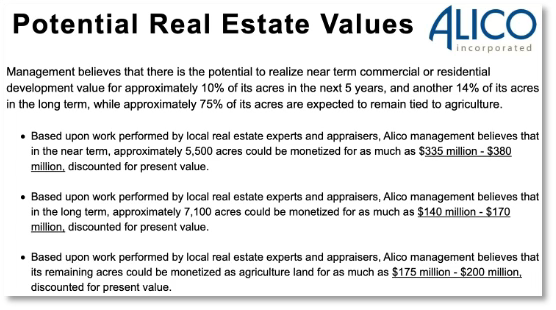

Plain-straight yield on investment

Out of the 53 thousand acres 10 % is utilized in near-term development, which is going to provide most of the near-term value. This part is exceeding the current enterprise value, and the approx. 350 million value is already being discounted to present value. Unfortunately, I have no idea what the discount rate used in this estimation is but if I had to guess it would be closer to/or over double digits if we compare it to market transaction prices. We’ll do some absolute dollar amount estimations later in this report. The long-term development potential is considered to be around 140-170 million dollars with 15% of current total land portfolio, also presented in discounted value. The rest, or 75% of the land value tied to agriculture without working capital needs is only stated at the present value of 175 to 200 million dollars. I mean, how many years of discount they have put into the long-term development and remaining agriculture-based land not utilized for historical Alico operations. This is where most of the opinions I have seen go wrong, investors confuse the already (zero-coupon) yielding value. If the values were reversed to absolute dollars the enterprise value in the market is far off from current value.

If we clean up the table and start with simple estimations between 6% to 12% discount rates (maybe) used by Alico we would arrive at an annual return of 22-38% on current total enterprise value undiscounted. But NOTE that if we divide the future value for five years (72,3 usd per year for five years) and discount those to present value at 6% rate per year the near-term portfolio alone would pay off the current enterprise value. This still means that the rest, discounted land portfolio has ZERO value priced in the Alico shares. Basically we are buying 48 thousand, yes, thousand, acres of prime land from the fastest growing state in America for free.

Tick Tock

Even though, there is 75% of the total land portfolio tied to some kind of agricultural business in a form or another, it should provide additional income but in a scale that is not so important for this investment to work out in the bigger picture. And regarding the current market dynamic in Florida, there are high odds for positive surprises.

There are already some hints about the remaining 75% of portfolio being used more effectively in the future. Alico clearly states that agricultural revenue remains until the best use for these 75% of agricultural properties can be realized. Shortly, high value developments are not limited to current near-to-medium term projects. It is impossible to value this company precisely, but it is easy to figure out that it is far from fair value with risk-free-alike prospects, and it is easily worth at least higher end of the stock option threshold of 45 dollars. Only big risk in this case that I see is a total meltdown of American real estate market. I don’t think investors have to look further than the investor presentations released in 2025 and search for some light Florida real estate market information.

PS. my friend David told me that the discount rate used by Alico was between 10 to 15% so the undiscounted annual approximate yield on EV is around 40%, which discounted back at risk free rate reveals huge mispricing in this company. Literally time is money in this investment. Thanks for reading.